For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line.

How does the contribution margin affect profit?

For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. The contribution margin ratio takes the debit and credit cheat sheet analysis a step further to show the percentage of each unit sale that contributes to covering the company’s variable costs and profit. Many companies use metrics like the contribution margin and the contribution margin ratio to help decide if they should keep selling various products and services.

Contribution Margin Per Unit Formula:

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. One common misconception pertains to the difference between the CM and the gross margin (GM). You work it out by dividing your contribution margin by the number of hours worked.

When to Use Contribution Margin Analysis

In the dynamic world of business, understanding key financial indicators is essential for effective decision-making. This financial concept plays an indispensable role in determining the profitability of individual items sold by a company and informs critical decisions about pricing, production quantities, and product lineups. Contribution margins are often compared to gross profit margins, but they differ. Gross profit margin is the difference between your sales revenue and the cost of goods sold. Fixed costs usually stay the same no matter how many units you create or sell. The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units.

Net sales are basically total sales less any returns or allowances. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential.

- It is considered a managerial ratio because companies rarely report margins to the public.

- Variable costs, on the other hand, increase with production levels.

- This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs.

- Variable expenses can be compared year over year to establish a trend and show how profits are affected.

- The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output.

These costs would be included when calculating the contribution margin. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin.

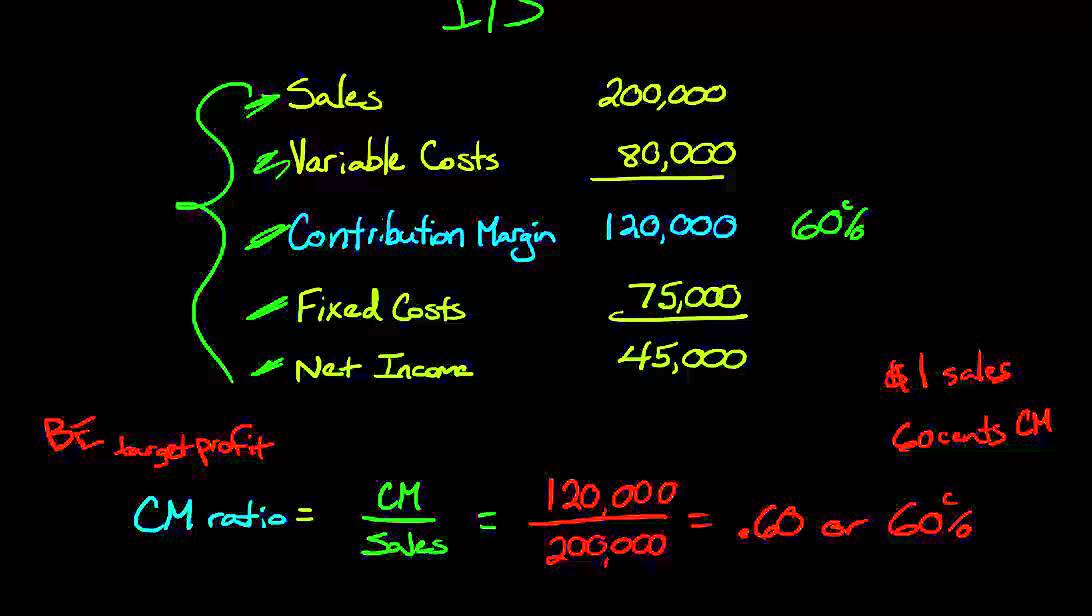

Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. Dobson Books Company sells textbook sets to primary and high schools. In the past year, he sold $200,000 worth of textbook sets that had a total variable cost of $80,000. Thus, Dobson Books Company suffered a loss of $30,000 during the previous year. That is, fixed costs remain unaffected even if there is no production during a particular period. Fixed costs are used in the break even analysis to determine the price and the level of production.

Find out what a contribution margin is, why it is important, and how to calculate it. These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. Learn about the time interest earned ratio and how to calculate it. The following are the disadvantages of the contribution margin analysis. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.